[

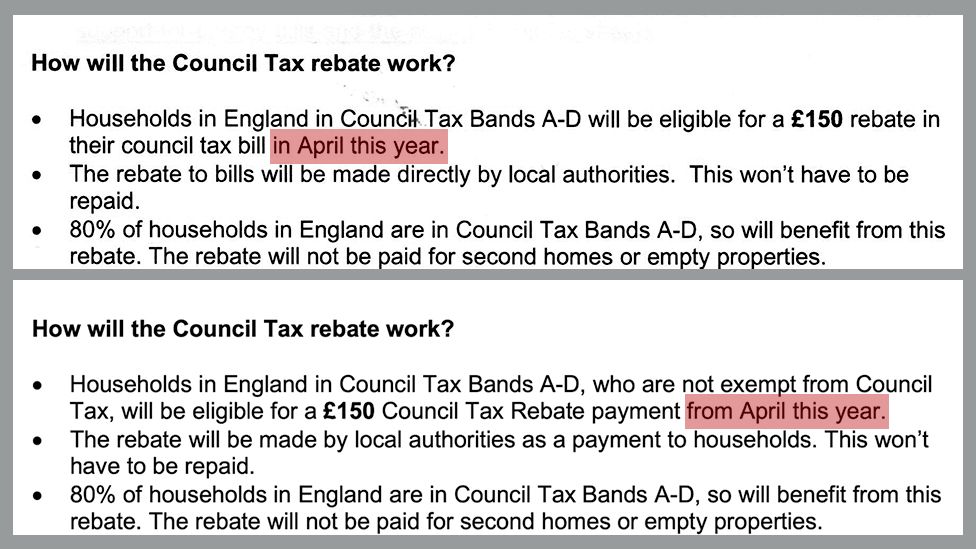

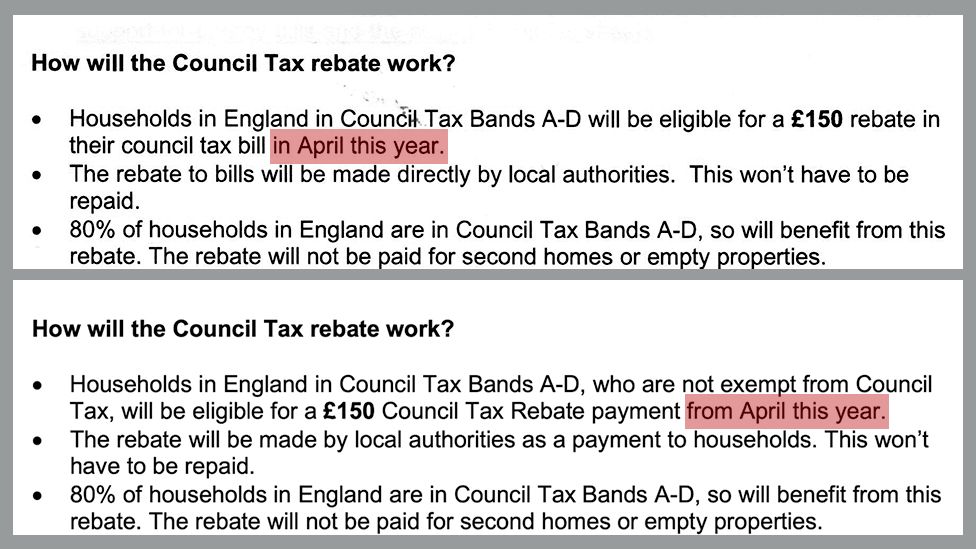

The Chancellor's pledge that councils in England

would make a £150 payment

towards domestic energy bills "in April" has been

broken in some areas.

While some have paid, Radio 4's Money Box

has found many have not and the guidance

has changed to "from April".

The deadline for payment, which applies to

homes in council tax bands A-D,

is September.

The government said councils were expected

to begin making payments as soon as

possible from April.

The deadline for payment,

which applies to homes in

council tax bands A-D, is September.]

[

In Scotland councils have been told they

can give the £150 as a direct discount

off their council tax - and many have done that.

There is no council tax in Northern Ireland but the

executive there has been given money

to make the payments but that is held up

by the political uncertainty.]

https://www.bbc.co.uk/news/business-61270840

This is terrible for some people

that thought from April they will get £150

.

.

Linear Mode

Linear Mode